Overview:

Reconcile with Synder

Our customers have found that the most accurate way to record all Stripe sales, fees, and refunds is to sync everything into a “clearing” account in the QuickBooks Chart of Accounts. First, Synder will create a “Stripe (required for Synder)” account. Once your Stripe withdraws money to your Bank, Synder will record a transfer from your Stripe (required for Synder) account to your Checking account, showing you the actual money flow, when funds first hit your Stripe account and then are transferred to the bank checking with the help of Stripe QuickBooks Online integration.

Note: Before you start, make sure that you currently don’t have any other synchronization apps, which could lead to duplications.

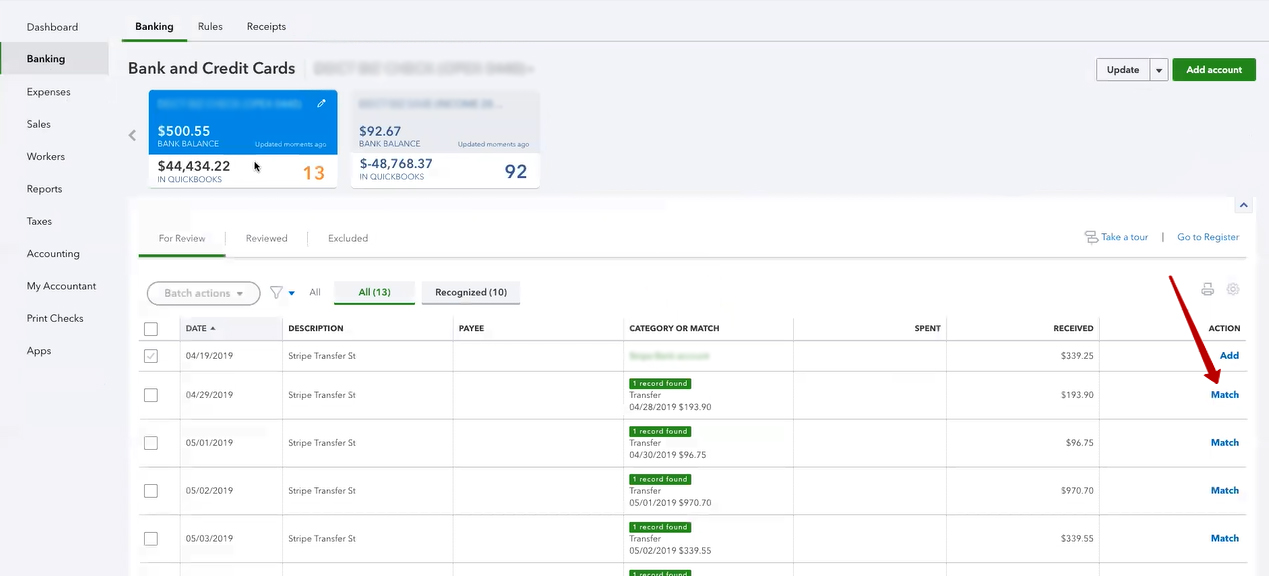

QuickBooks “pre-matches” the transfer from “Clearing” to “Checking” account for the same amount of the bank statement line. On this step, QuickBooks makes a guess, which of the bank statement lines corresponds to a particular transaction that is created in “Checking account“. Thus, it offers you to confirm its guess by clicking “Match“. So, you can easily reconcile in QuickBooks Online.

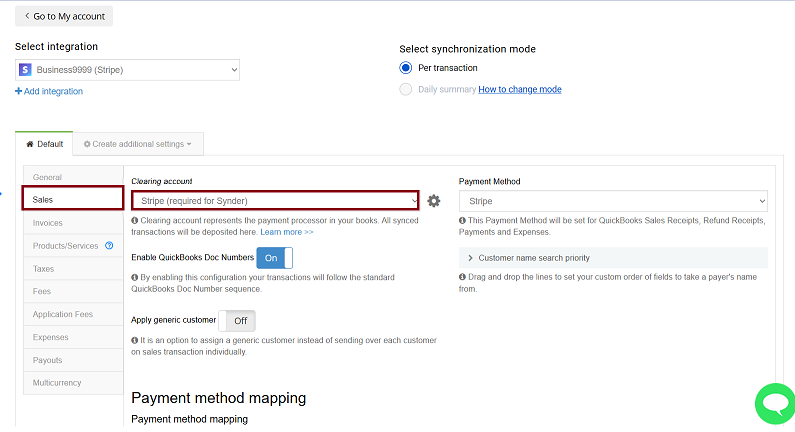

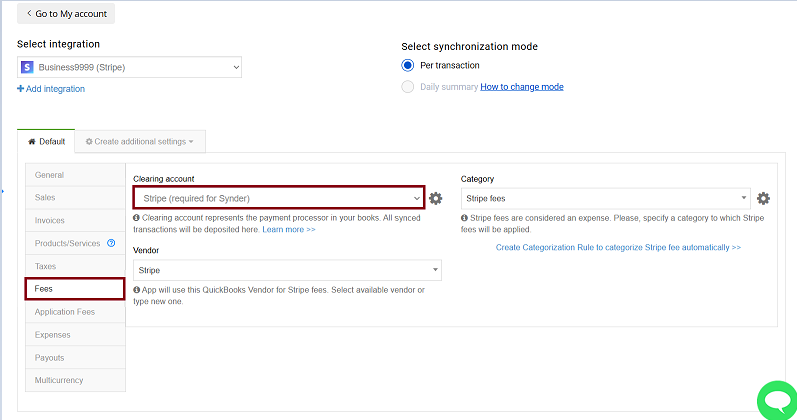

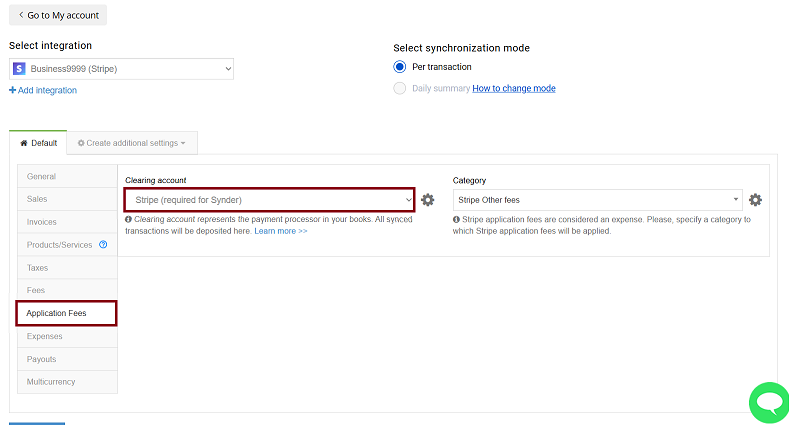

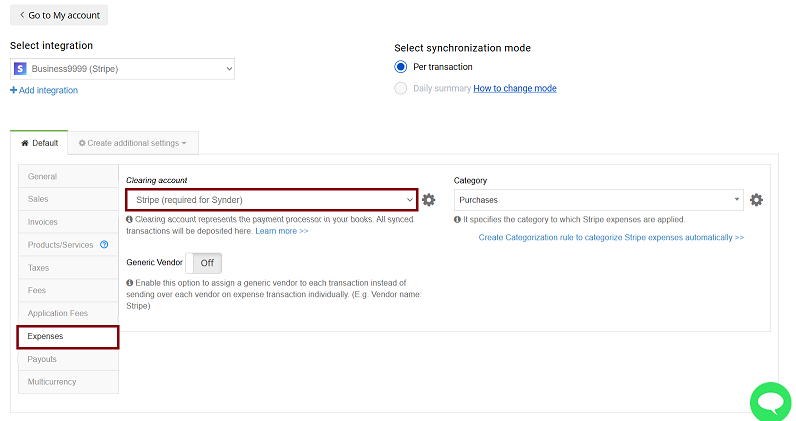

Customize your Synder settings

If you don’t have an account with “Stripe” in it, Synder will auto-create it. Check your Synder settings to make sure you have that account selected as a Clearing account in Sales, Fees, Application Fees and Expenses. See how to customize your Stripe settings.

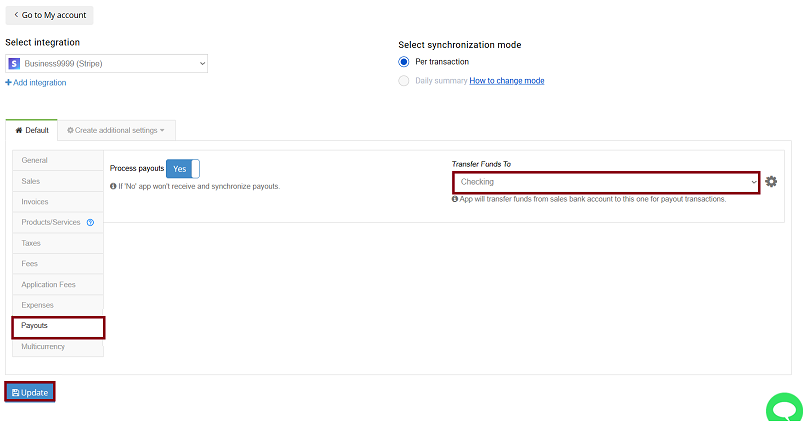

Enable the payouts feature and select your Checking account into which you deposit actual funds from Stripe in Transfer Funds To in order to automate the matching process.

Remember to click on “Update” after changing any settings.

You can synchronize Stripe payments manually or set up an auto-sync.

How to reconcile in QuickBooks Online

Open For Review list in QuickBooks Banking and click on match next to Stripe withdrawals.

*Keep in mind that according to the way you set up your Stripe, in most cases, real funds from Stripe are transferred to your checking account 3-7 days after the actual payment took place.

Congratulations! You have successfully pulled in all Stripe data and can easily reconcile your checking account, now avoiding manual data entry and recording all sales, fees, expenses, and refunds.

Why is it important to reconcile your bank statements?

When you reconcile your business bank account, you compare your internal financial records against the records provided to you by your bank. A monthly reconciliation helps you identify any unusual transactions that might be caused by fraud or accounting errors, and the practice can also help you spot inefficiencies.

Note: The difference should be 0 once you match all the transactions needed to prove that your accounting is correct.

Reach out to the Synder team via online support chat, phone, or email with any questions you have – we’re always happy to help you!